Innovate governance.

-

Gerhard Fasol: Corporate Governance Reforms in Japan (talk at the FCCJ Foreign Correspondents Club of Japan, in Tokyo)

As one of a tiny number of foreigners with experience as Board Director of a publicly listed Japanese corporation, Gerhard Fasol speaks about his experience as Board Director, and his hands-on views on Japan’s corporate governance reforms. FCCJ event information: Professional Luncheon: Gerhard Fasol, CEO, Eurotechnology Japan KK https://www.fccj.or.jp/event/professional-luncheon-gerhard-fasol-ceo-eurotechnology-japan-kk (c) 2022 Eurotechnology Japan KK. All…

-

Corporate Governance Reforms in Japan, Swiss-Japanese Chamber of Commerce in Geneva

Corporate Governance Reforms: How the Way Japanese Corporations Take Decisions is Changing SJCC Swiss-Japanese Chamber of Commerce Friday 12 October 2018, 18:30-19:45, JETRO Office Geneva Prime Minister Abe’s corporate governance reforms are arguably one of the biggest success stories of his reform program to promote Japan’s economic growth. Japan’s Government in coordination with the Tokyo…

-

Corporate governance reforms: making Japanese corporations great again? Monday, May 28, 2018, 19:00-21:00 at CCIFJ

Corporate governance reforms: making Japanese corporations great again? Understanding how Japanese Boards of Directors function helps you close deals Monday, May 28, 2018, 19:00-21:00 at CCIFJ Stimulating Japanese companies’ growth is a key element of Prime Minister Abe’s economic growth policies. For companies to grow, management needs to be improved, Boards of Directors need to…

-

Corporate governance reforms in Japan: hands-on insights as Board Director of a Japanese group

Corporate governance reforms are one of the key components of Abenomics, to improve economic growth in Japan Corporate governance reforms in Japan: talk at the OAG House in Tokyo, Wednesday 20 September 2017, 18:30-20:00 Wednesday 20 September 2017, 18:30-20:00 Talk: Gerhard Fasol: „Corporate Governance Reformen in Japan: Erfahrungen als Aufsichtsratsdirektor einer japanischen Firmengruppe“ Free of…

-

Corporate governance reforms in Japan: a talk at the Embassy of Sweden

Corporate governance reforms in Japan Changing the way Japanese corporations are managed: Can it make Japanese iconic corporations great again? A talk by Gerhard Fasol at the Embassy of Sweden organized by the Embassy of Sweden, The Swedish Chamber of Commerce in Japan (SCCJ), and the Stockholm School of Economics Abstract: Changing the way Japanese…

-

Association of Foreign Board Directors of listed Japanese Corporations – inauguration meeting

The co-founders of the Association of Foreign Board Directors of listed Japanese Corporations held the inauguration meeting on Thursday 14 April 2016 in Hong Kong. Gerhard Fasol, Co-Founder and Co-Chair Jason Sausto, Co-Founder and Co-Chair Copyright·©2015-2016 ·Eurotechnology Japan KK·All Rights Reserved·

-

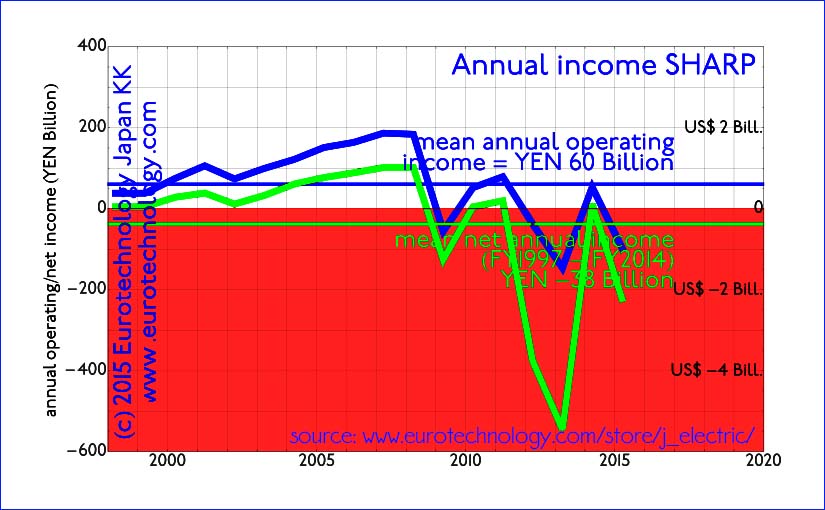

SHARP governance and Japan’s electronics sector

SHARP and Governance SHARP is a Japanese electronics company with 44,000 employees and YEN 3000 billion (US$ 30 billion) in sales, many factories and a product portfolio ranging from rice cookers, office copiers, solar panels, robots, mobile phones, to supplying APPLE with displays. SHARP faces repayment of YEN 510 billion (US$ 4.2 billion) in short-term…

-

Japan corporate governance 2016

Japan corporate governance and economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood…

-

Corporate governance Japan: practical views of a foreign Board Director

corporate governance Japan: A Board Director’s view Corporate governance reforms in Japan progress faster than even one of their key promoters expected, and cost almost no tax payers money Author: Gerhard Fasol corporate governance Japan: reforms of Japan’s corporate governance practice are one component of “Abenomics” to bring back economic growth to Japan. Corporate governance…

-

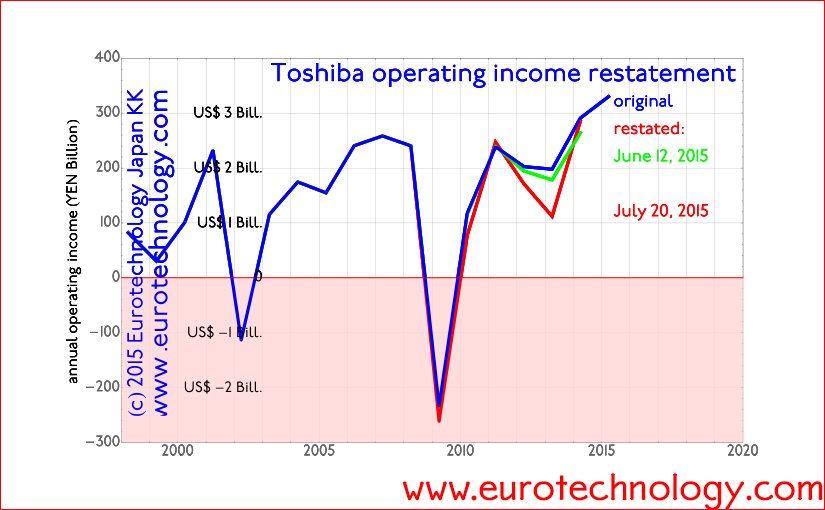

Toshiba income restatement: corporate governance issues

Toshiba’s income restatement announced by the independent 3rd party committee Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the Tokyo High Court,…

-

Japan Exchange Group CEO Atsushi Saito: surprised about the speed of implementation of corporate governance reforms in Japan

New Dimensions of Japanese Financial Market Only with freedom and democracy, the values of open society and professionalism can the investment chain function effectively The iconic leader of the Tokyo Stock Exchange since 2007, now Group CEO of the Japan Exchange Group gave a Press Conference at the Foreign Correspondents Club of Japan on June…